According to Visa, Tap-To-Pay transactions grew by 30% over the past years.

Nearly 50% of US shoppers say they won’t shop at a store that doesn’t offer a cashless way to shop.

Every business, whether offline or online, needs a payment processor and payment processing services to cater to the changing behavior of consumers. Besides ensuring the transactions are carried out seamlessly, it also improves customer experience and business reputation.

Since payment processing directly impacts your revenue, making informed decisions is crucial, especially in selecting the right payment processors. After all, the payment processor you choose affects everything from your potential to collect online payments, to your customer service, to your business’s bottom line.

Choosing the one payment processor that’s a good fit for your business may sound an uphill task. But, considering the main things like fee structure, PCI compliance, and excellent customer support, it’s simple as ABC.

Before we dive deep into understanding the nitty-gritty of choosing the right payment processors, it’s important to have a quick rundown of where it all started – “Payment Processing Services.”

In simple terms, Payment processing is how businesses complete credit card and debit card transactions. Payment processing is providing a person, indirectly or directly, different means to charge or debit bank accounts through the use of any payment mechanism.

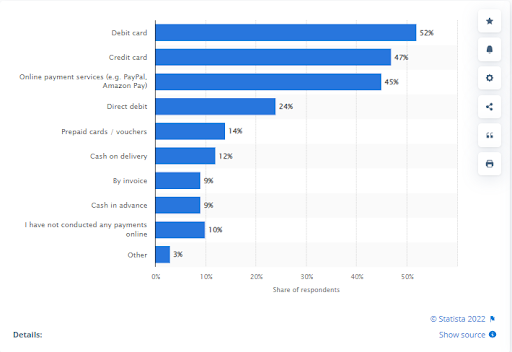

Payment processing is not just about credit or debit cards, it’s much more than that. Though debit and credit cards are the most popular payment method at this time, more options to accept payments are cementing their footstep in the hierarchy, like contactless, mobile and online payments.

Therefore, offering consumers more efficient ways to pay for goods is a key objective for all modern business owners.

To start, let’s first review what and how payment processing work, including terms that specifically relate to your business.

Introduction to Payment Processing:

To a naked eye, the payment processing might seem as simple as a credit or debit card tap, swipe or a dip, merely taking a few seconds. However, there’s more than that. It involves several steps and players, like:

- Customers

- Merchant/Business

- A payment processor

- Payment gateway

- Bank, credit or debit company

- Business bank or merchant accounts

Who are the Main Players in Processing Payments?

To simply put, in debit or credit card processing, whether online, through phone sales, or even in person, there are three main players:

On one side is you, the business owner or merchant, while on the other is your customer. And, in between lies the technology that bridges the two of you.

#Player 1: You, The Merchant

To accept credit and debit card transactions from online customers, you need to partner with some key players. As a business owner, you’ll likely need a merchant bank (also termed as the acquirer) that accepts payments on your behalf and deposits them into the provided merchant account.

#Player 2: Your Customer

For your customer to pay for the services and goods used, they need a credit or a debit card. The bank that approves them for the card payments and credits them the cash to pay you is known as an issuing bank.

#Player 3: The Technology

Between lies the two technologies that allow you and your customer to make a transaction.

First is the payment gateway, a software that links your website shopping cart to the processing network. Next comes the payment processors (or merchant service), which does all the leg work like moving the transaction through the processing network, working with the bank, sending a billing statement, doing debit or credit card processing, etc.

The final outcome is a customer who successfully makes a purchase without cash – along with a business that completes a sale.

Some Key Payment Processing Stats On How US Customers Will Be Paying For Goods and Services Moving Forward

Before you can decide which payment processing method is right for you, it’s better to know what market stats say about it.

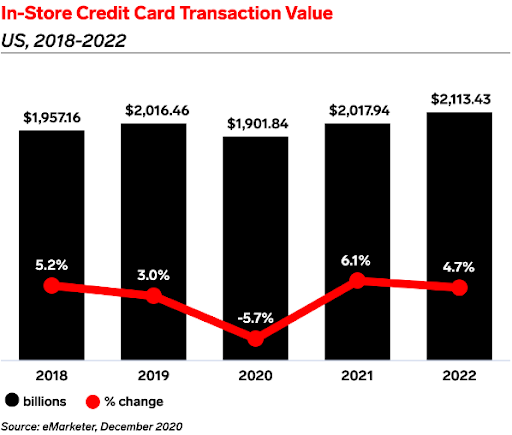

1. Credit Card Payment Processing

Credit card processing is a system through which data from the customer’s credit card is transmitted for approving a dollar transaction from their bank account to the merchant account.

While there was a dip in in-store credit card transactions during the pandemic, Insider Intelligence predicted that the value would reach $2, 223.43 in 2022.

2. Online Payment Processing

Online payment processing links a website with a payment processor to connect a merchant account to a credit and debit card issuer. Furthermore, merchant accounts can set up recurring payments, accept or decline transactions according to pre-set parameters, and process payments made with foreign currency.

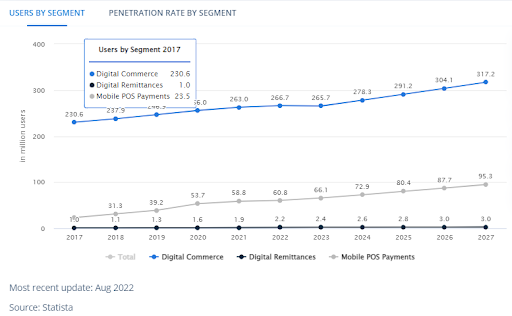

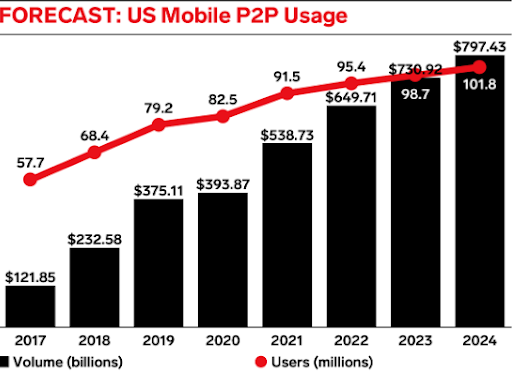

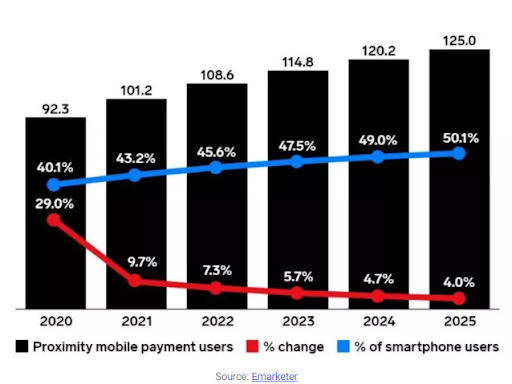

Furthermore, the epidemic accelerated the adoption of mobile payment platforms, as Americans sought out retailers offering contactless services. As a result, users, as well as transaction value growth, have accelerated.

Furthermore, the epidemic accelerated the adoption of mobile payment platforms, as Americans sought out retailers offering contactless services. As a result, users, as well as transaction value growth, have accelerated.

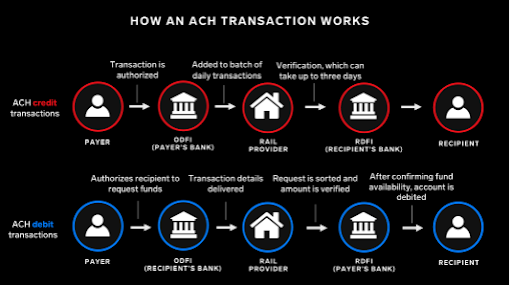

3. ACH Payment Processing

ACH (Automated Clearing House) is a network used to route payments electronically between banks across the United States. Typically, there are two types of ACH payments:

- Credit ACH Payments

- Debit ACH Payments

Conventionally, ACH was developed as a way for banks to process paper checks digitally. But, since it has become digitally reliant, with online ACH including 27.9% of transactions by volume in the third Quarter of 2020, as per the NACHA (National Automated Clearing House Association) ACH is growing not only in segments like disbursements, bill pay, and direct deposit, but also for digital P2P transactions and online transfers.

To put in all, ACH is emerging, not just in check-based segments like bill pay, disbursements, and direct deposits, but also for online and digital P2P transactions.

4. Merchant Payment Processing

Merchant payment providers let merchants accept credit and debit cards and all other forms of payment from consumers easily. While merchant acquirers allow payment transactions, merchant payment processors are responsible for securely transmitting data related to those transactions and offering several degrees of back-office support.

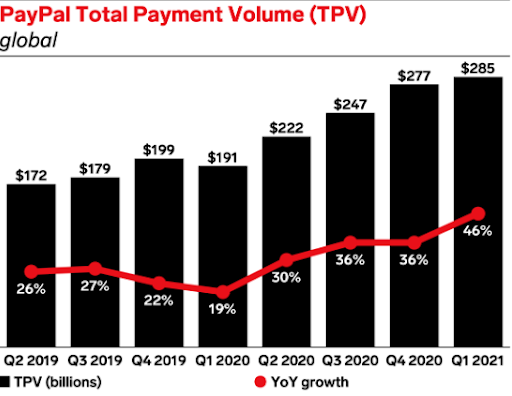

For example, PayPal growth amid the pandemic witnessed an unprecedented rise as merchants relied on the firm to facilitate transactions. But, as of August 2021, PayPal changed its fee structure, making merchants pay $3.98 in fees for a $100 transaction, compared to $3.20 before.

This change made merchants think of leaving PayPal and switching to reliable payment service providers like GETTRX, which offer their own processing services.

The best option significantly depends on your business sales volume and payment accepting method.

Now, you would think, “What happens when you process a payment?” So, let’s uncover the answer!

How Does Payment Processing Work?

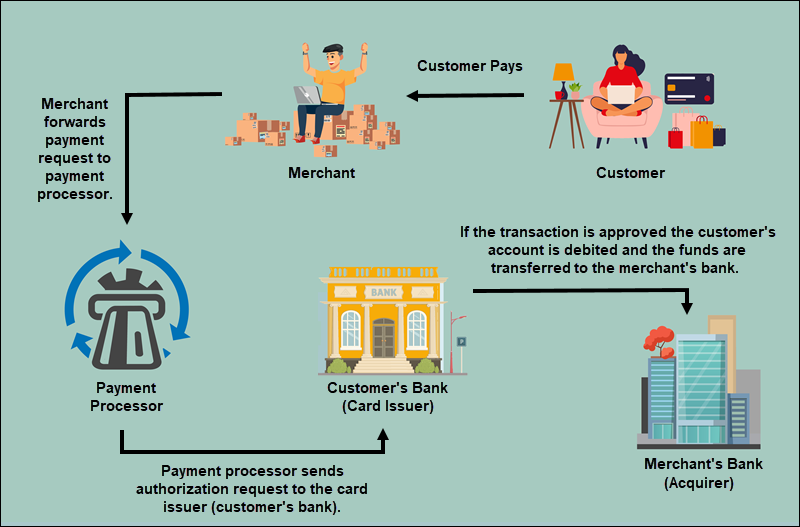

On the surface, payment processing seems simple, but there’s much more than swiping or tapping debit or credit cards. It includes services like authorization, funding, and settling of a transaction.

Here’s what happens when you make a purchase.

When a customer makes a purchase, the payment is made with the card at the point of sale, popularly known as POS. Though the transaction takes a second, the process behind the trade is intricate.

#Step 1: Engage at the Point Of Sale

The point of Sale system is the time and place where a retail transaction is completed.

So, payment methods at a point of sale vary from debit or credit card payments to online payments, checks, cash, etc. Consumers are using digital payment methods to make in-store and online purchases.

According to new projections from PwC, the volume of cashless payment transactions globally is predicted to surge by more than 80% between 2020 and 2025, expected from 1 trillion to 1.9 trillion.

#Step 2: Connecting To A Payment Gateway

A payment gateway is a mechanism that reads and transfers payment information from a customer’s to a merchant’s bank account.

#Step 3: Payment Processor Comes in the Picture

The merchant sends a request to their respective payment processor for the authorization of the transaction. Further, the payment processor carries out essential steps:

- The payment processor submits the transaction to the respective card association associated with the issuing bank.

- The issuing bank accepts or rejects the payment based on pre-set parameters.

- Next, the issuing bank sends either an approval or a rejection status back to the merchant bank and finally makes it to the merchant account.

# Step 4: Transfer Funds to the Merchant Account

The process of settling and funding comes when a transaction is processed and approved. This is actually where the transaction is deposited into the merchant’s account.

The card association is related to the issuing bank; therefore, the issuing bank receives the transaction details and further carries out the process, which consists of:

- The issuing bank charges a defined sum from the cardholders for the transaction.

- Then the issuing bank transfers the appropriate amount to the merchant bank, subtracting the interchange fee.

- The merchant bank transmits the amount to the merchant account.

The complete process happens quickly, between the time order is placed, and the moment the receipt is handed to you.

Why Does Your Business Need Payment Processing?

Practically for every business, it’s a matter of when?

As customer preferences for making payments continuously evolve away from cash and check transactions, it just makes sense to have electronic payments flow into the business accounting system.

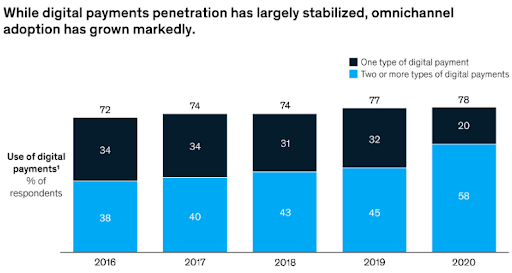

Exhibit 1: US Customers Prefer More Digital Commerce

Exhibit 2: Omnichannel Digital Payment Adoption has Grown Exceptionally

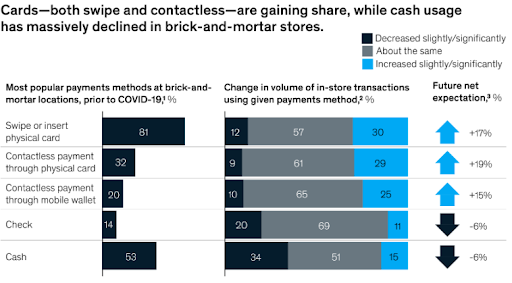

Exhibit 3: Contactless and Card–Gaining Share

These stats shed light on the “Digital First” approach for payment.

As payments evolve into a crucial differentiator and revenue driver, there can no longer be an afterthought of “if.” After all, in today’s fast-moving and unpredictable global environment, payment is the focal point of your business strategy, and digital innovation is a trusted way to prepare your treasury for the future.

And as a matter of fact, payment processing services are not merely a necessity. It’s much beyond that. It includes untold benefits for businesses.

Let’s find the answer to the frequently asked question:-

How It’s Beneficial for Your Business – Offline or Online?

Payment processing services and businesses go hand in hand.

For retailers as well as software services, seamless payment services are Un skippable for the success of their platform. So, here’s a breakdown of the many benefits of integrated payment processing.

#1. Open Wealth of New Revenue Streams

No doubt, monetizing your platform can open a wealth of new revenue streams. The possibilities are never-ending, from confining premium content behind a paywall to providing different payment systems based on customer usage.

One incredible prospect of a payment processing integration is an additional revenue stream through revenue sharing. Revenue sharing allows software businesses to earn money from the transaction fees their customers pay to accept credit cards through the integration. Actually, it’s the same types of costs that the software company pays to accept credit cards, but here, they are on the receiving end of the fees.

Moreover, integrated payment processing allows you to provide several types of payment models based on what’s ideal for your business. So, whatever the preference is, the core is the same: you have control over how payment works for your business. And you can easily choose and pursue new revenue streams through that control.

#2. Increase The Value of Your Brand

By establishing a convenient payment system in your business, you are automatically increasing the value of your platform.

The convenience, security, and reliability of a strong payment system is invaluable to the customers.

Not to forget, having payment processing directly integrated into your platform eliminates the challenges customers face in entering, improving their experiences. Simply put, it increases the likelihood of customers buying from you.

So, by making payments easy and safe for your customers, you are expanding the value of your complete platform.

#3. Reduce Labor Costs

Payment processing services are one of the ways you can save your business costs.

Payments will flow directly into the general ledger at the payment moment. This clearly means that it’s no longer required to have a dedicated receivable employee on the payroll. Besides, paying an accountant to re-enter data from credit card transactions to reconcile accounts is no need.

Therefore, you’ll save the cost and time spent on training employees to process payments as the process turns much simpler and easier.

#4. Integrate Seamlessly With Your Existing Platform

A well-built payment processor will easily integrate with your platform.

But integrating doesn’t mean you have to change your model to adapt to the payment system – instead, the processor adjusts to you. Trusted and modern payment processing systems like GETTRX are adaptable and user-friendly, so you can integrate them into your platform seamlessly.

#5. No More Worries About Security and Compliance

By using payment processing secure services, you’ll save on those endless headaches of generating invoices while leveraging the benefits of integrated payments.

When you host payments, you’ll have to go through the tedious process of audits and IT scans. It’s expensive, difficult to maintain, and resource-intensive. But, with a reliable payment processor, you don’t have to worry about it – your company never has to carry the onus of any personal and financial information.

You can sigh relief knowing your client’s data is secure without sweating the security details.

In the same vein, choosing the right payment processor can be an overwhelming process, whether you’re new to the game or making a switch.

But, with untold payment processing platforms available in the market today, choosing the right one might seem daunting. Fortunately, we are here to help you.

How to Choose the Right Payment Processor?

And to prevent that, here are a handful of top things you should consider when choosing the right payment processor.

First thing first!

Make sure your payment processor has a solid understanding of how your business works.

Here are some helpful tips to get you pointed in the right direction. Let’s look!

#1. PCI Compliance

Security is imperative.

So, your payment provider must take all the necessary steps to integrate compliance with the PCI Data Security Standard (PCI DSS). And, if they are not PCI compliant and cannot help your business complete the official PCI DSS Self Assessment Questionnaire to validate your compliance, then it’s a red flag; step back!

You must be wondering why it’s important.

Yes, it is because if a business is not compliant, they are putting itself and its customers at risk. Imagine a team that offers you a vast selection of payment solutions, plus provides PCI DSS security professionals who can assist your business in achieving compliance.

#2. Excellent Customer Support

Arguably the most Un skippable factor that most merchants overlook as the payment processing is “behind the scenes.”

But what if something goes down unexpectedly? Will your payment provider be available when you need help?

#3. Integrations

Does your business use accounting software, ERP or CRM? Or, maybe you have a front-end POS system that helps you in your business?

Therefore, by having a reliable integrated payment solution into your existing system, you will minimize human data entry errors and save time and money through automated reconciliation.

Helpful Tip – Not every integration will be a walk in the aisle, but your payment provider should be capable of assisting you to walk through your integrations or even offer to help you set up.

So, ensure your payment provider helps you make your integration quick and easy.

Our experts will work with you to ensure your systems are up to snuff.

#4. No Hidden Fees

Before you put your finger on the payment processor, ensure your provider is transparent about fees.

Further, on top of standard Visa, Mastercard, and Amex, look for standard processing rates as cards have different costs. And providers need to include a fee schedule that makes these costs more transparent, whether that’s monthly fees, statement fees, batch and authorization fees.

Arrayed with this knowledge, you now have all the most relevant information to set up online payments for your business and select the best option for your company.

Hopefully, these considerations drive you straight to your next payment processing decision. If you are still sitting on the fence about what payment processor to choose, want to switch payment service providers for a better integration or cost, or are a curious head – just get in touch! We are here for you.

This content is originally published at GETTRX on September 26, 2022.