Civil Liability insurance, also known simply as RC, is a great ally when developing your professional activity or business. Its function is to cover possible damages that both you and your employees may inflict on third parties in the performance of your work. For example, if you are a yoga teacher and someone is injured during your class or if you have a store and a client slips when entering.

This is something contemplated in articles 1903 and 1902 of the Civil Code that establish the obligation to repair the damage caused by action or omission intervening fault or negligence both on the part of the insured and the employees in his charge.

Civil Liability coverage can make the difference between continuing with your business or going bankrupt in the event of an accident.

In the event of an accident and claim by a third party, this Civil Liability coverage could make the difference between continuing with your business as normal or going bankrupt due to the high costs of compensation involving personal, material or economic damage caused. to third parties during the exercise of professional activity. In addition, the RC also covers the constitution of bonds and legal expenses required of the insured for possible claims by third parties in case of determination in court.

Depending on the coverage, there are different types of Civil Liability insurance that we will see below, but if you are still wondering if it is necessary to take out a policy of this type, you should know that it is one of the most important and best-selling insurance policies to protect business activities. . In addition, it is mandatory in some risky professions such as gas fitters or nurses.

What exactly does Civil Liability insurance cover?

In general, the civil liability insurance for Self-Employed covers material, personal and economic damage to third parties up to an amount agreed in advance. This is the case, among others, of damages caused to movable and immovable property or the benefits that a business that has been forced to close as a result of an accident caused in your business stops receiving.

Although the details depend on the specific policy that you take out, in general terms, a RC policy also guarantees legal assistance or advice to the insured against any unforeseen event and civil liability for business operation or, in other words, the payment of the compensation that a third party may demand for the damage caused.

RC policies cover material, personal and economic damage to third parties up to an amount agreed in advance.

Your profession is also important when determining what coverages you would need. For example, if you belong to the construction sector, it would be interesting to take out a policy with the employer, locative, adjoining, and post-work CR in the case of working on renovation works. If in your case you work in new construction, it would also be advisable to hire the subsidiary RC and adjoining risks, among others. On the other hand, if your profession is related to installations, you will need Civil Liability insurance that covers employer, locative, adjoining RC, risk of damage to pre-existing assets, and finished work, among others.

In addition to the variable coverage depending on the profession, there is also the possibility of assessing the coverage to be contracted depending on the type of insurance plan we are talking about. In the case of SingularCover, a basic plan of this type of policy covers civil liability up to €300,000 with legal assistance included. For its part, a Pro plan would allow you to be more covered, since, in addition to the two previous points, it also includes operating civil liability, employer coverage, and post-work civil liability. Finally, the maximum guarantee in terms of coverage is that provided by a Plus plan. The latter includes Civil Liability up to €600,000 and everything mentioned in the Pro plan.

If you are going to carry out work abroad, you must request the insurance company to include it and pay the corresponding surcharge or, where appropriate, make an extension of coverage if you already have insurance for that specific case. Another possibility is to take out specific insurance for the activity you are going to carry out abroad.

Is it mandatory to take out Civil Liability insurance?

Specifically, the Civil Liability insurance for SMEs and the Self-Employed is mandatory to practice professions such as electrical and gas installers, doctors, nurses, and other self-employed who need to have a special title to be able to carry out their activity. This is due to the high risk of damage that could occur during their profession.

In general terms, it can be said that a Civil Liability policy is mandatory by law, among others, for the following professions :

- Bankruptcy administrators

- Financial sector professionals

- Private health personnel such as doctors, nurses, and physiotherapists

- Lawyers

- Insurance brokers

- Professionals from the leisure and entertainment sector

- Managers of sports facilities (gyms, swimming pools…)

- Travel agency

- School and collective transport companies

- Hospitality and restoration

- Construction (architects, promoters, builders…)

In the rest of the cases, this coverage is not mandatory but it is recommended since the indemnities are usually so high that, if they do not have this coverage, they could even close the business. In addition, when applying for the license to open commercial premises, the municipalities require this type of insurance. In this way, even if it was not mandatory due to the profession or sector to which the Self-Employed belongs, it would be if they need to open a place to carry out their activity.

Requirements to take out Civil Liability insurance

If you need insurance to be able to carry out your professional activity, but you do not know the details to be able to choose the coverage that best suits your business, answering this question can help you: Do you have a shop ? If the answer is no, Civil Liability insurance is what you are looking for.

This policy covers the risks specifically related to your profession and to hire it the only requirement you have to meet as a SME or Self-Employed is to be registered in the RETA (Special Regime for Self-Employed Workers) or in the Corporation Tax . To take out a CR policy, you only need to be registered with the RETA or with the Corporation Tax.

You must provide documentation that proves it and also provide registrations in the General Social Security Scheme (RGSS) of your employees. It is also necessary to present the necessary documentation to prove your professional activity and, if possible, a report that establishes the most important risks derived from it for third parties. In the event that you work on a construction site, for RC insurance, the license or permit of the same is also requested. Finally, if you have a premises, it would be advisable to take out Commercial or Multi-Risk insurance to cover both you and your premises since these types of policies have Civil Liability included.

And if what you need is something much more specific, at SingularCover we are specialists in insurance for SMEs and the self-employed. We design your custom policy, customizing 100% the coverage that your business requires.

What is the price of Civil Liability insurance?

The policy you choose, the coverage and the type of professional activity you want to protect directly influence the price of the Civil Liability insurance you can take out. That is why it is difficult to answer the question of how much Civil Liability insurance costs.

However, an approximate calculation can be obtained taking into account the number of employees that the company has (the more workers it is deduced that there may be greater risk) and the location . In fact, certain municipalities require certain types of coverage on a mandatory basis that directly affect the price of the policy.

The type of professional activity, the coverage and the number of employees influence the price of the insurance that you are going to need.

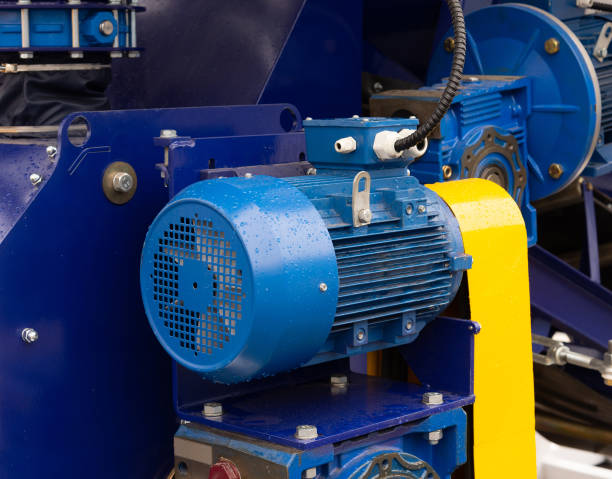

Also, if you work outside the home or use heavy equipment or expensive property, these factors will make the insurance quote you need higher. Finally, the turnover of the business and the experience are also decisive in calculating how much a certain CR insurance costs although, in the case of turnover, it would only be relevant if it exceeds 2 or 3 million euros (the vast majority of businesses and self-employed would be below that level)

Even though customization is a very key factor when it comes to RC insurance prices, to see an example, we can find a basic RC policy for builders from 13 euros per month, while there are basic plans with the essential minimum coverage from 15 euros/month for professions related to installations.

Prices should be 100% adapted so that all Self-Employed and SMEs pay exclusively for what they need and are protected from the high cost of compensation that could arise from damage caused to third parties during the exercise of their profession. On the SingularCover website, you can find more information about it and even calculate the price of your insurance yourself in just 1 minute.

Is Civil Liability insurance deductible?

Yes, although it has nuances. A Civil Liability insurance is 100% deductible as long as it exclusively covers the professional activity of the Self-Employed or SME. It is understood that insurance is an expense derived from their professional activity in the same way that the purchase of office supplies could be, with the difference that, in the case of insurance, the Self-Employed or SME could not only deduct VAT (in fact insurance is exempt from this value-added tax), but the total amount of your policy . In addition, the material insurance contracted by the Self-Employed (or companies) to protect their fixed assets are also 100% deductible.