You’ve heard everything previously – you really want to deal with your FICO assessment. In any case, what comprises a success with regards surprisingly score? How do you have any idea when your score is among awesome?

To start with, a few realities: When you hear the term FICO rating, the vast majority are alluding to your FICO score. These are really FICO scores. You have three separate scores – one from every one of the three significant credit announcing organizations in view of the data they have.

This implies that your Equifax FICO score might be unique in relation to your Experian or TransUnion result, yet it is possible not radically unique.

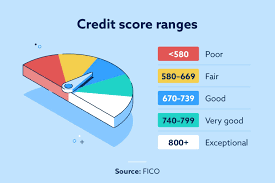

The most noteworthy conceivable score is 850 while the least is 300. In actuality, coming to a 850 is most likely not going to occur. It would take an ideal blend of many variables to arrive.

What is the enchanted number that will give you the wellbeing rates, installment terms and advantages that come from being positioned among the most elite?

As indicated by Anthony Sprauve, overseer of advertising at FICO, assuming you have a FICO score over 760, you will get the best rates and open doors.

How troublesome is it to get that number? Seeing midpoints is anything but a simple errand. The normal FICO rating in America is in the 670-739 territory.

Assuming that these measurements appear to be somewhat discouraging, simply relax. Regardless of whether you arrive at that desired number of 760, dislike you need to pay cash only for the remainder of your life.

Great score for various purposes

For instance, assuming you are hoping to purchase a home, a score of 500 qualifies you for a FHA credit. Be that as it may, many significant moneylenders require a base score of 580 for FHA advances.

Customary home loans are difficult to find with a score under 620 and a few moneylenders expect no less than 700. That is the reason monetary masters exhort individuals hoping to purchase a home not to miss charge installments or beat themselves up with cards. credit or different advances. You will require heavenly credit to turn into a property holder much of the time.

Recall that the better your financial assessment, the lower the loan fee and the less you will pay.

Consider a $200,000 30-year contract at a proper rate: as indicated by one dataset, the distinction in financing costs for individuals with 760 focuses versus 620 could be 1.6%. That was a distinction of $68,000 over the existence of the home loan.

Ongoing measurements have shown that vehicle leaseholders with a FICO assessment of 720+ paid $6,304.40 less on a five-year vehicle advance than those with a FICO rating of 620-Range 659. In the two cases, the higher your score, the better your terms – and the less you’ll pay in interest.

the main concern

On the off chance that you’re not having a decent outlook on your financial assessment, there are ways of supporting it. Peruse the most effective ways to fix your FICO assessment and 10 methods for further developing your credit report for tips. Comprehend, in any case, that your score isn’t probably going to improve rapidly.

With sensibly amazing good fortune with your pay and wellbeing, taking great consideration of your FICO rating is generally presence of mind: don’t owe individuals truckload of cash either, take care of your bills on schedule, and succumb to no features that say, “We can work on your score.” short-term credit.”

Assuming you go through awful times, center when you can, return and follow as frequently as could be expected.