Are you one of those people who walks around with a car without insurance? Are you aware of the risk you run?

Buying a car is not something cheap and even less so if it is a recent model. While a new car is usually insured, when you’re done paying for it, you may mistakenly think that keeping it insured is an added expense.

in this blog, we have talked about some problems you could get into for causing damage to a third party.

If this happened, you would have to take responsibility for repairing other people’s property that damages you, as well as their injuries.

This coverage, Civil Liability, is the one that protects you from the most expensive risks resulting from an accident.

However, this coverage only prevents you from spending your money to compensate other people. What happens to your assets?

For this, there is Material Damage coverage, included in the Comprehensive or Comprehensive PlusPackageof car insurance.

In addition, this set of coverages protects your car against natural disasters that normally cause severe damage.

As you know, these types of phenomena are becoming more frequent and intense, and when they happen, you could hardly avoid them.

HOW DOES THE MATERIAL DAMAGE COVERAGE FOR NATURAL DISASTERS WORK?

Property Damage coverage in auto insurance protects you against physical damage (commonly a crash or rollover).

However, this coverage in Mexico encompasses a greater number of risks that cause another type of damage:

- Crashes and rollovers in three different scenarios:

- That you have been responsible and in addition to repairing the damage caused to a third party, you also have to take care of your own.

- When some sudden or unexpected factor causes the damage and is not the responsibility of a person. This is known in insurance parlance as “Force Majeure.”

- When a third party damages your vehicle and refuses to compensate or runs away.

- Breakage, detachment, or theft of the car’s windows (windshield, rear medallion, and side windows.

- Damage due to fire, explosion (of external origin), or lightning strike.

- Attempted robbery(even if no pieces have been removed)

- Damage caused by acts of vandalism, terrorism, demonstrations on public roads, and actions carried out by the police to discourage them.

- Natural phenomena:

- Hydrometeorological: cyclone, hurricane, hail, flood, storm surge.

- Geology: earthquake, volcanic eruption, avalanche, the collapse of earth or stones, fall of constructions, buildings, structures, falling objects, or falling trees or their branches.

HOW MUCH WOULD THE INSURER PAY ME FOR A CLAIM RELATED TO A NATURAL DISASTER?

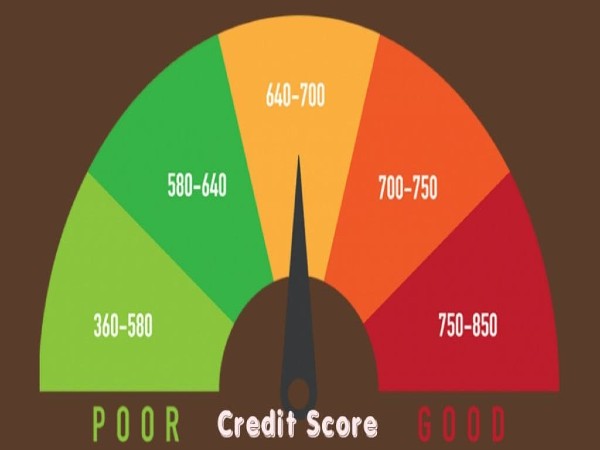

The maximum amount that an insurer pays in each coverage, in case of loss, is called Sum Insured.

Thus, the material damage coverage for natural disasters has its own sum insured, independent of civil liability or any other.

This coverage does not normally have a fixed Sum Insured, as others such as civil Liability.

Rather, it is estimated with the “Blue Book”, which monthly updates the prices of each model and their respective depreciation and which is accepted by the entire automotive industry.

This variable amount is called “Commercial Value”.

There are two other ways to establish the maximum amount that the insurer will assign to the Material Damage coverage:

- Invoice Value: normally applies to cars up to two years old and its advantage is that the Sum Insured does not change due to the depreciation of the car, but rather maintains that stipulated in the car invoice.

- Added Value: if your car has special equipment or adaptations that increase its price, you can agree on an amount with the insurer and keep it fixed, regardless of the vehicle model.

However, choosing one of these last two options makes the price of the insurance more expensive.

How do they work? In the event of a total loss of the vehicle due to material damage due to natural disasters, the insurer would pay you the maximum amount established, be it commercial value, invoice value, or the agreed value.

Now, if the damage does not cause a total loss, this Sum Insured will pay for the necessary repairs during the term of the policy, until the amount is exhausted.

HOW DOES THE DEDUCTIBLE WORK IN THIS COVERAGE?

Material Damage coverage normally has a deductible of 5% of the value set in the policy (commercial, invoice, or agreed).

For example: if your car has a commercial value of $100,000 thousand pesos, the deductible will be $5,000 thousand pesos.

In case of a total loss, the insurer will give you $100,000 thousand pesos less the deductible, that is, $95,000 thousand pesos.

If it is partial damage and the repair costs less than $5,000 thousand pesos, you will have to pay it. This is because the deductible (your share of the loss) comes in first, and then the insurance applies. If the damage is for $7,000 thousand pesos, you will pay the first $5,000 thousand pesos and the insurer the remaining $2,000 thousand and so on.

But remember that this only applies to Material Damage, each coverage has its own sums insured and deductibles.

According to estimates by the Mexican Association of Insurance Institutions (AMIS), in 2015 insurers in Mexico paid around $22 billion pesos for property damage. This was equivalent to 45% of all compensation contained in car insurance ($47,000 million pesos).

You can adjust the deductible amount

You have the right to request that the percentage of the deductible be modified, even eliminated. If you reduce or eliminate it, the price of coverage will increase. If you increase the deductible, the cost is reduced.

WHAT DOES THE PROPERTY DAMAGE COVERAGE NOT COVER?

The factors or incidents that are not covered by this coverage are called exclusions.

They are generally the following, although each insurer can make additional modifications:

- Damage to mirrors, skulls, or headlights.

- Breakage, mechanical breakdown, or wear of any part of the vehicle as a result of the use or lack of maintenance.

- Damage caused by the cargo itself, is not related to any of the risks covered by the policy.

- Damage caused by the tide (even if it causes a flood). It is the only natural risk that is not covered by the coverage.

- Deterioration intentionally caused by the contracting party, insured or regular driver of the car, relatives, or acquaintances.

- Failures or breakdowns are caused by overloading the vehicle or subjecting it to excessive traction beyond its capacity.

- Weakening of the vehicle due to water entering the engine when the insured has not stopped and turned off the vehicle due to flooding. Although there are insurers that cover this risk in additional coverage at a cost.

- Damage to adaptations or special equipment of the vehicle that was not originally installed. To protect them, they must be included in an additional clause called: Conversions, Adaptations, and Special Equipment.

- Intentionally causing damage to the car with the intention of performing fraudulent actions.

- Damage was caused to the car during a demonstration in which the owner of the vehicle participates.

WHAT TO DO IN CASE OF A NATURAL DISASTER?

In case you require auto insurance because it was damaged as a result of a natural phenomenon, consider:

The primary factor during an eventuality of this type is to protect your integrity, above any good.

If you live in an area susceptible to a natural disaster such as near a river or near a volcano or geological fault, try to have all your important papers at hand, including a copy of your car insurance.

When the natural disaster passes, do not try to move or start the car (for example after a flood).

If you do this and as a consequence cause more serious damage, you will cause a situation called: risk aggravation.

In this case, the insurer might not pay you.

It is best to leave the car as it is and call the accident service number.

There, the insurer will tell you what you have to do and the documentation you must submit to process your claim.

Normally the payment term is between 5 and 10 business days, from the moment you deliver all the requested documents.

Both the adjuster and your agent will be able to advise you on the next steps to continue your process.

In case you are dissatisfied with the amount to be compensated or some other circumstance such as the attention received by the insurer’s staff, remember that you can go to the National Commission for the Protection and Defense of Users of Financial Services.

CONCLUSION ON NATURAL DISASTERS

The vast majority of insurers in Mexico have very robust coverage for auto insurance.

However, many times we do not read the clauses in detail and thus we do not know exactly how they work or what all their benefits or limitations are.

Many times it seems boring to read all these clauses and sometimes there are terms that are not very common to understand.

We invite you to contact a coinsurance agent to help you choose the best option in terms of packages against natural disasters.